A brokerage account is a type of investment account that allows you to buy and sell securities such as stocks, bonds, and mutual funds. It is an essential tool for anyone who wants to invest in the stock market and grow their wealth over time. In Nepal, the stock market has been growing rapidly in recent years, and more and more people are looking to invest in it. However, opening a brokerage account in Nepal can be a daunting task for many people. In this blog post, we will provide you with a step-by-step guide on how to open a brokerage account in Nepal and help you get started on your investment journey.

Documentation Required forIndividual TMS Account Opening

- Nepalese Citizenship (Original and Photocopy of citizenship certificate)

- Recent Passport size photograph

- Birth Certificate and Guardian

- Citizenship

- (In case of minor) Bank Account

- Details

1. Documents required: To open a brokerage account in Nepal, you will need to provide some documents such as your citizenship certificate, passport-sized photographs, and a copy of your PAN card. You may also need to provide additional documents depending on the brokerage firm you choose.

2. Fees involved: Different brokerage firms in Nepal charge different fees for opening and maintaining a brokerage account. Some firms may charge a flat fee, while others may charge a percentage of the value of your investments. You should research different brokerage firms and compare their fees before choosing one.

3. Types of brokerage accounts: There are two main types of brokerage accounts available in Nepal – online and offline. Online brokerage accounts allow you to buy and sell securities through an online platform, while offline brokerage accounts require you to visit the broker’s office to place orders. You should choose the type of account that best suits your needs.

4. Choosing a brokerage firm: When choosing a brokerage firm in Nepal, you should consider factors such as the fees charged, the quality of customer service provided, and the reputation of the firm. You can read reviews online and ask for recommendations from friends and family members who have experience with investing in the stock market.

TMS Account Opening Process Stepby Step

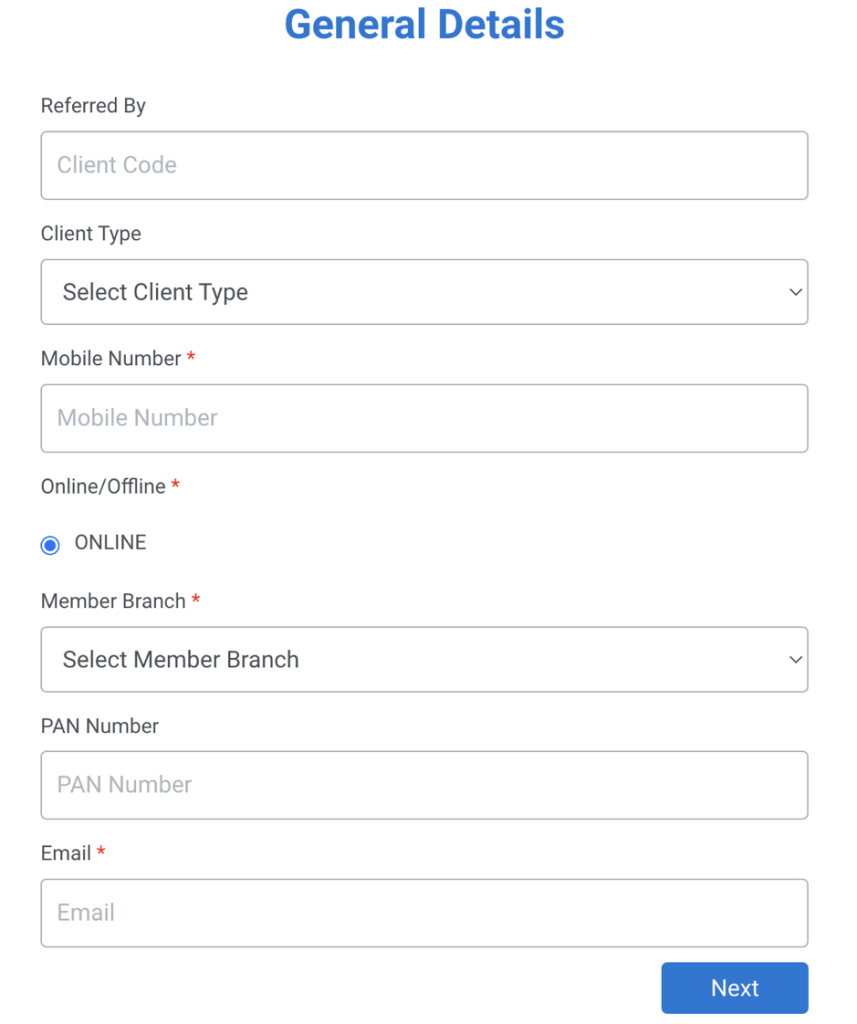

- Click the online TMS client

registration

portal: https://tms41.nepsetms.com.np/client

registration - After clicking on that, you’ll get a new

page where you have to enter your

general details including client type,

mobile number, broker member branch,

email address, and PAN number.

Select Client Type: Individual

Fill all the required form. (*

indicates mandatory)

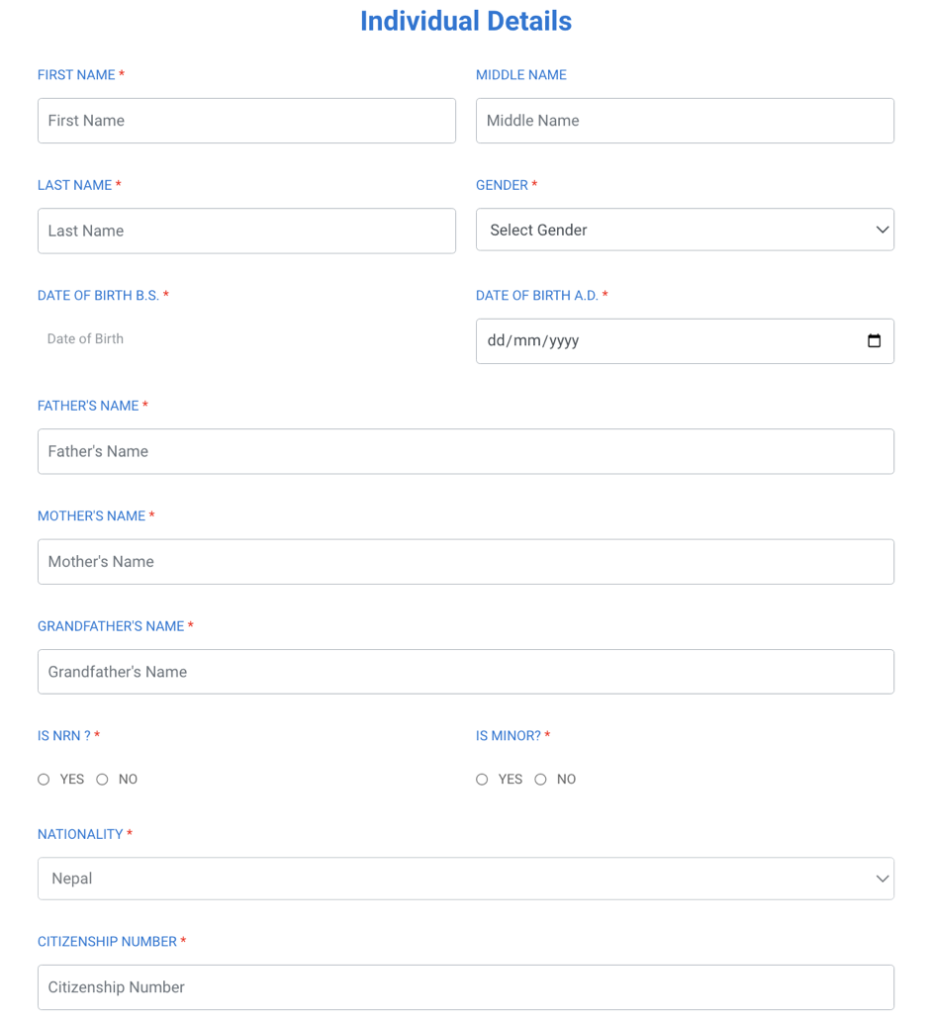

3. Fill out the general details and clickthe next button. On the following pageyou have to enter your individual detailsincludingname, dateof birth,father/grandfather name, citizenshipdetails, marital and financial details etc.

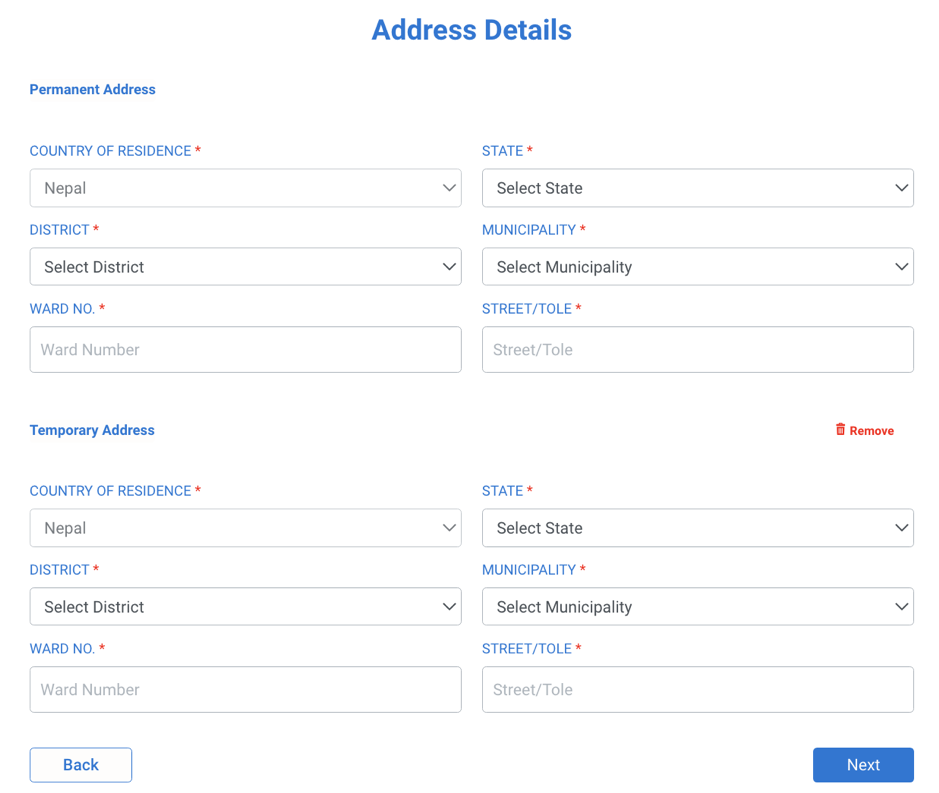

After entering all the requiredindividual details, press next. On thefollowing page, you have to enter youraddress details ncluding permaneniand temporary address.

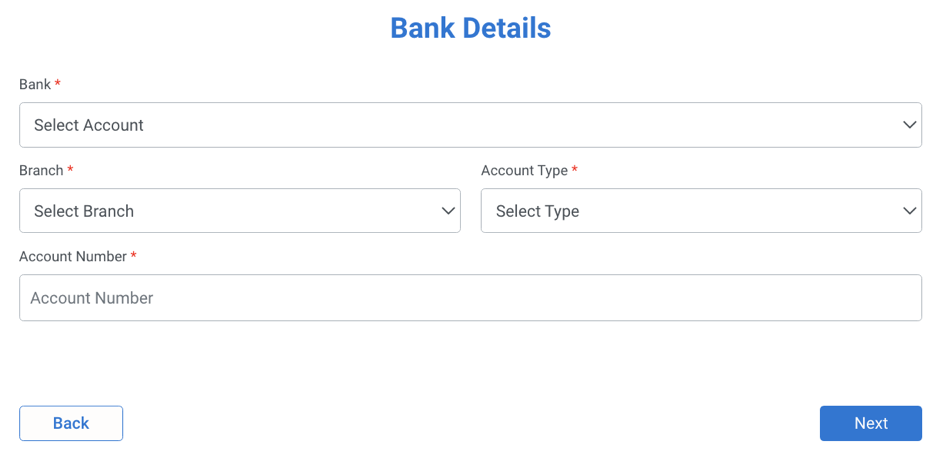

After filling out the address detailselick next. On the following page, youmust enter your bank details.

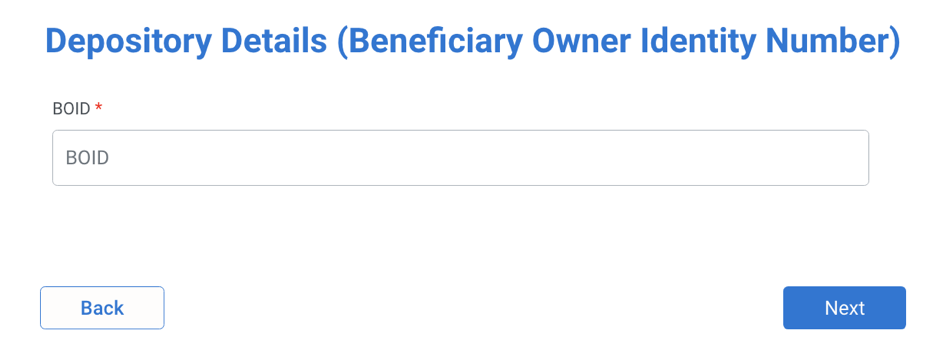

Properly fill out the bank details andclick next. Fill the depository details (i.e1 6 numbers DEMAT account number)on the following page.

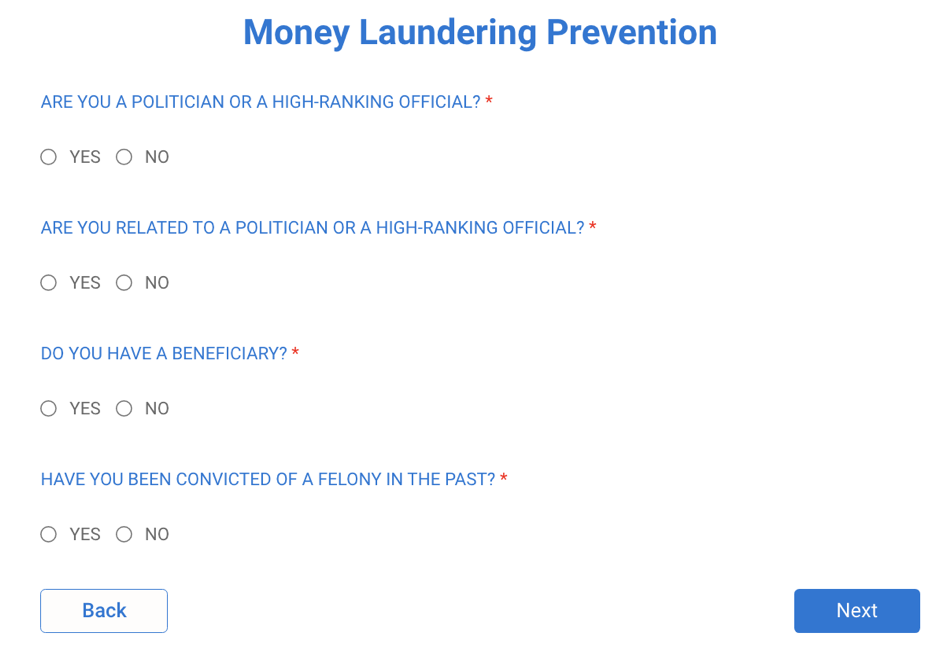

After completing the depositorydetails, click the next button. On thefollowing screen, you have to answerthe some yes/no question for money laundering prevention purpose.

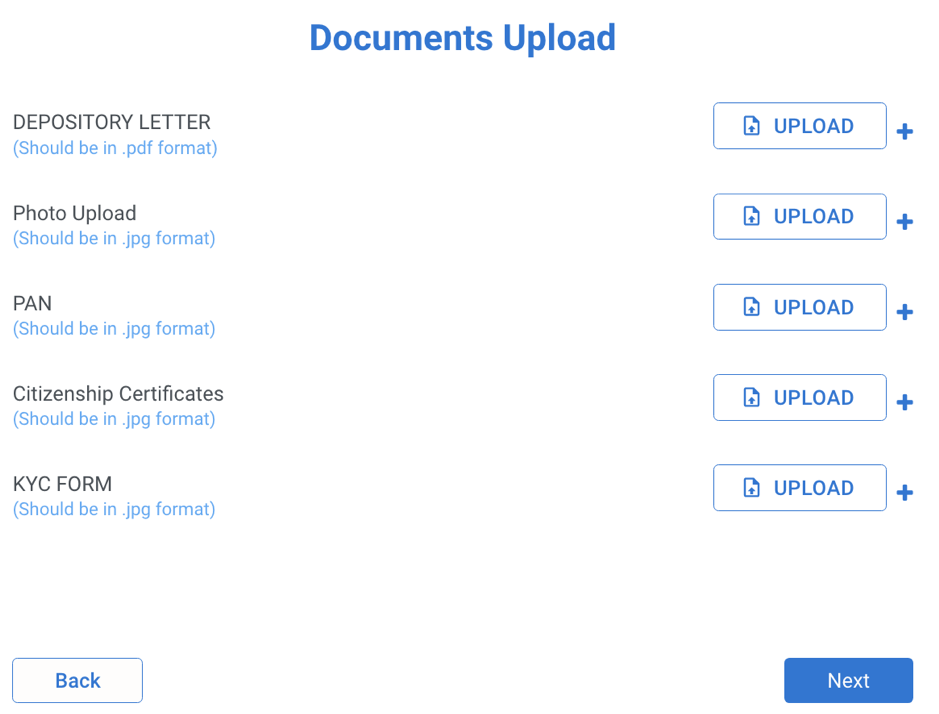

Next upload required documentsUser can upload multiple documentsfor same document type by clicking onplus symbol and remove existingupload by clicking on Cross symbol.

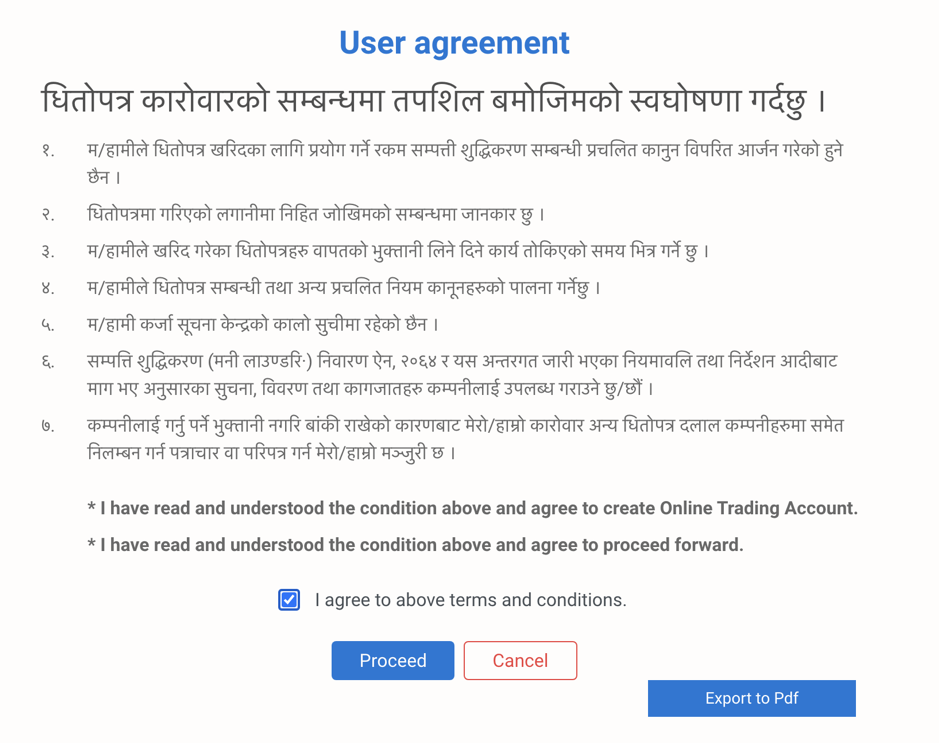

The user agreement shows on thenext page when the necessarydocuments have been uploaded.Carefully read each terms andconditions before proceed theapplication, agree terms and conditionsand click proceed.

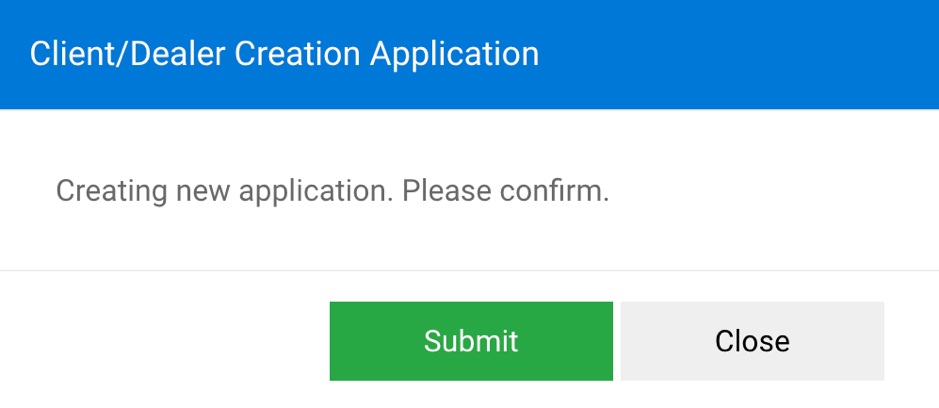

Note: You may also print the agreement or export to PDF for future reference. Lastly submit the application.

The broker will then approve theapplication after certain time and notifyyou via e-mail by providing client id andpassword.